Today, I’m feeling extra blunt and getting straight to the point.

There are two types of property appraisals: the quick, DIY, free online ones (watch out, they’ll demand your phone number and email, and you’ll soon be swimming in SPAM) and the “professional” ones, slow, precise, and yes, paid.

For a free online appraisal, all it takes is a quick search, a few clicks, and voilà! You get a magical number telling you what your house is worth. Sure, but that number is about as reliable as tomorrow’s horoscope.

If you want something real, there’s no shortcut: you need a professional property appraiser who knows the market, understands zoning laws, and has access to insider data your DIY method couldn’t even dream of.

With a professional appraisal, you're armed to the teeth for negotiations.

Let’s dive into why that matters!

In a heartbeat

- Only a professional appraiser, with a treasure trove of market knowledge and insider data, can give you a property valuation you can trust—like a secret weapon for negotiations.

- Finding an appraiser in Italy? Just ask one of the top agent associations (FIAIP, FIMAA) and watch them pull the right expert out of their hat.

- Classic Italian valuation methods: Whether using the OMI database, comparing overpriced listings, or the elusive "Rogiti in chiaro" method, Italy's property valuation is still gloriously traditional. Forget AI, we’re all about slow, human-powered precision!

Property appraisers in Italy

A property appraisal is needed in the following situations:

- Mortgage: The bank needs to know how much your property is worth before approving a loan.

- Auction: When a property is up for auction by a court, an appraisal is a must.

- Separation/Divorce: Yes, this is the sad part—someone needs to figure out how much your shared home is worth.

- Inheritance: An appraisal helps divide the estate fairly to avoid family drama.

- Buying or Selling: To ensure the price is fair—especially when a company needs to justify the value on their books or to shareholders.

Are there real estate appraisers in Italy?

Absolutely! In Italy, appraisers can be licensed real estate agents, certified appraisers registered with the Chamber of Commerce, or professionals like architects, engineers, and surveyors. However, there’s no single professional body just for appraisers, so various experts can handle this role.

Where to find an appraiser?

The quickest solution is to ask your trusted real estate agent or lawyer in Italy. Alternatively, you can contact one of the two leading Italian real estate associations, FIAIP [1] or FIMAA [2], and they’ll point you to the right professional based on your location and language!

The contents of an appraisal

After 15 years of reading everything from one-page summaries to novellas, here’s what makes a professional appraisal stand out:

- Key data includes the appraiser’s credentials and the client’s details.

- Property description: Identifiers like cadastral data, size, physical features, rooms, and accessories.

- Urban and cadastral analysis: Is the building legally compliant? Does everything match the blueprints? Are there any restrictions or easements?

- Property value: The appraisal method used (market comparison, depreciated reconstruction cost, income capitalization), price trends, a list of nearby sales, and factors that could increase or decrease the value (like exposure, floor level, light, noise).

A tip for foreign buyers: Yes, property value is crucial, but don’t overlook the urban and cadastral analysis. Building violations in Italy? Still common. Bureaucracy? Still a nightmare. I’ve seen sales collapse because of a misplaced window. So, focus on the legal aspects!

Why you need a property appraisal?

Two main reasons: to ensure you’re paying a fair price and to confirm the property is legally sound. If you’re selling, the appraisal helps you sleep at night (like I’ve explained in this article).

Quick tip: Ensure your appraiser is unbiased and has no conflicts of interest.

Key factors influencing property value in Italy

Let’s focus on the key factors that determine a property’s value. And when I say "key," I mean the top factors out of more than 40 that I personally use, each with its own percentage weight to calculate a final, balanced property value.

Side note: External features like balconies and gardens have skyrocketed in importance since the Covid era. Fresh air has never been more in demand!

The four main factors influencing property value are:

1] Commercial Surface Area

Commercial surface area is the total sum of the usable indoor space, the thickness of the internal and external walls, balconies, terraces, gardens, and other features like garages or storage units.

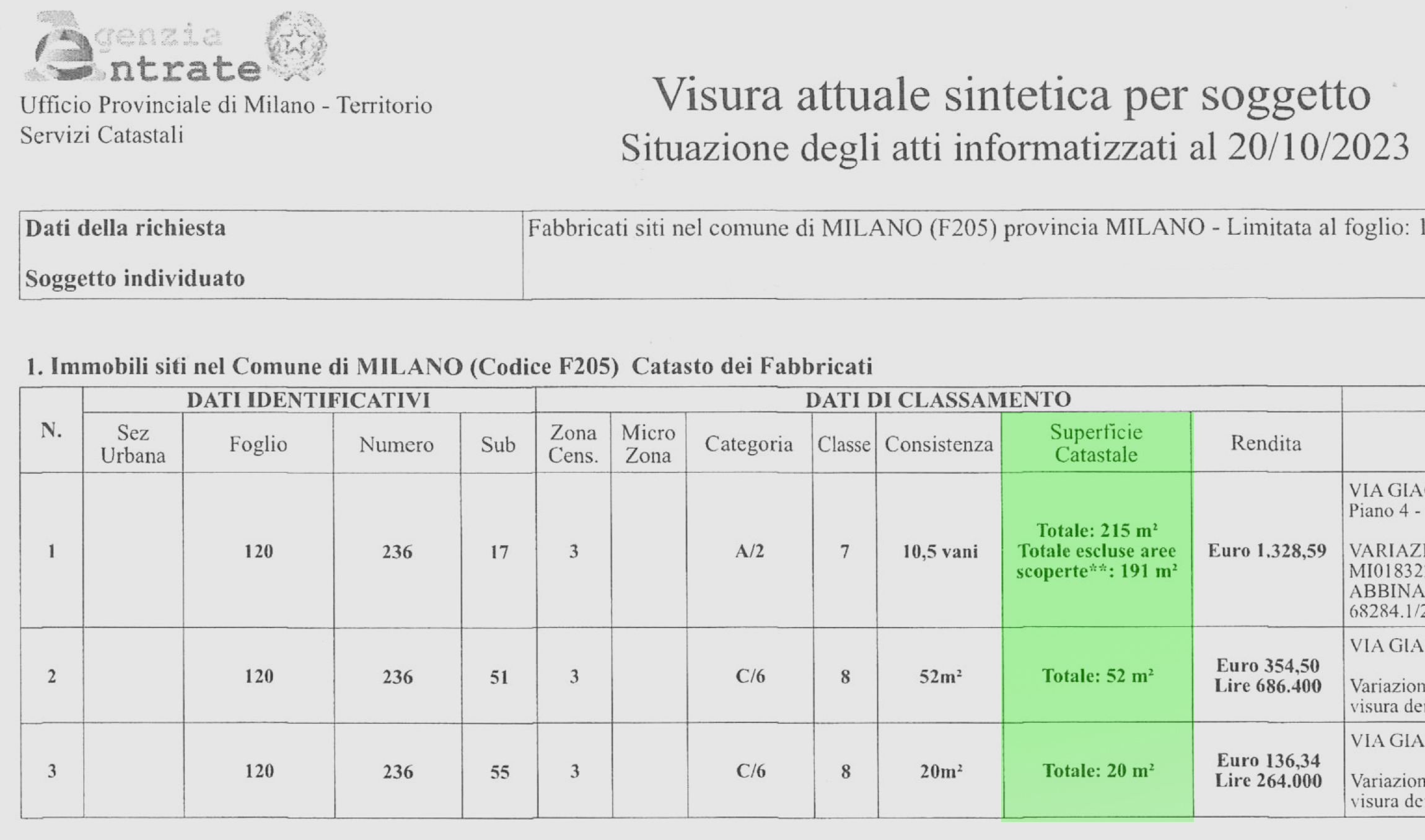

To keep it simple, check the cadastral document below for the total surface area (215 square meters).

To get the final commercial surface, add half garages and storage units area, plus a percentage (1-10%) of garden space based on its characteristics.

The property in the example doesn’t have a garden, so the final commercial surface area is calculated as 215 + 26 + 10 = 251 square meters. Simple math, right?

2] Condition and Renovation

The house’s condition can be a dream deal or a nightmare.

If your house looks like something out of a 1970s horror flick, brace yourself—renovations can run between €500 and €3,000 per square meter, depending on materials, labor, and your luck with finding a contractor who doesn’t vanish mid-project.

3] Geographical Location

Ah, the location!

If the “condition” is like the look of a property, the “location” is its personality. And we all know that, when it comes to houses, personality matters more than anything else!

A brilliant and somewhat mischievous motto is: “if you want to know the value of your house, tell me who your neighbours are.” This saying suggests that the value of a property depends not only on the walls and square metres, but also on who shares the street with you.

Translation: VIP homes are in VIP neighborhoods.

4] Cadastral Category and Property Income

Bureaucratic yet crucial, your property's cadastral category determines whether you’re in a luxury penthouse (A/1) or a more modest apartment (A/3). Higher categories mean higher selling prices—and higher taxes.

Oh, and don’t forget cadastral income (rendita catastale), which sounds promising but is really just a number that helps the tax office decide how much you owe annually. The higher the cadastral income, the higher your taxes... fun, right?

Beware: a high cadastral category also means higher taxes for the buyer, because the IRS is always very attentive to these details.

And then there is the cadastral income (rendita catastale), another term that sounds like something that should make you money, but actually tells you how much you will have to shell out each year in taxes.

The cadastral income is that figure which, when multiplied by various coefficients, becomes the cadastral value, i.e. the basis for calculating IMU and other tax amenities. The higher the annuity, the higher the value of your property goes up... and with it the taxes.

Step-by-step property valuation process

How to determine property value in Italy

In a country like Italy, where property prices range from €1 for an entire house to a staggering €30,000 per square meter in Portofino, it’s pretty clear that understanding the value per square meter in different regions is crucial.

While digital platforms, big data, and artificial intelligence are shaking up the real estate world, we still rely on good traditional valuation methods here in Italy. Here are five of them:

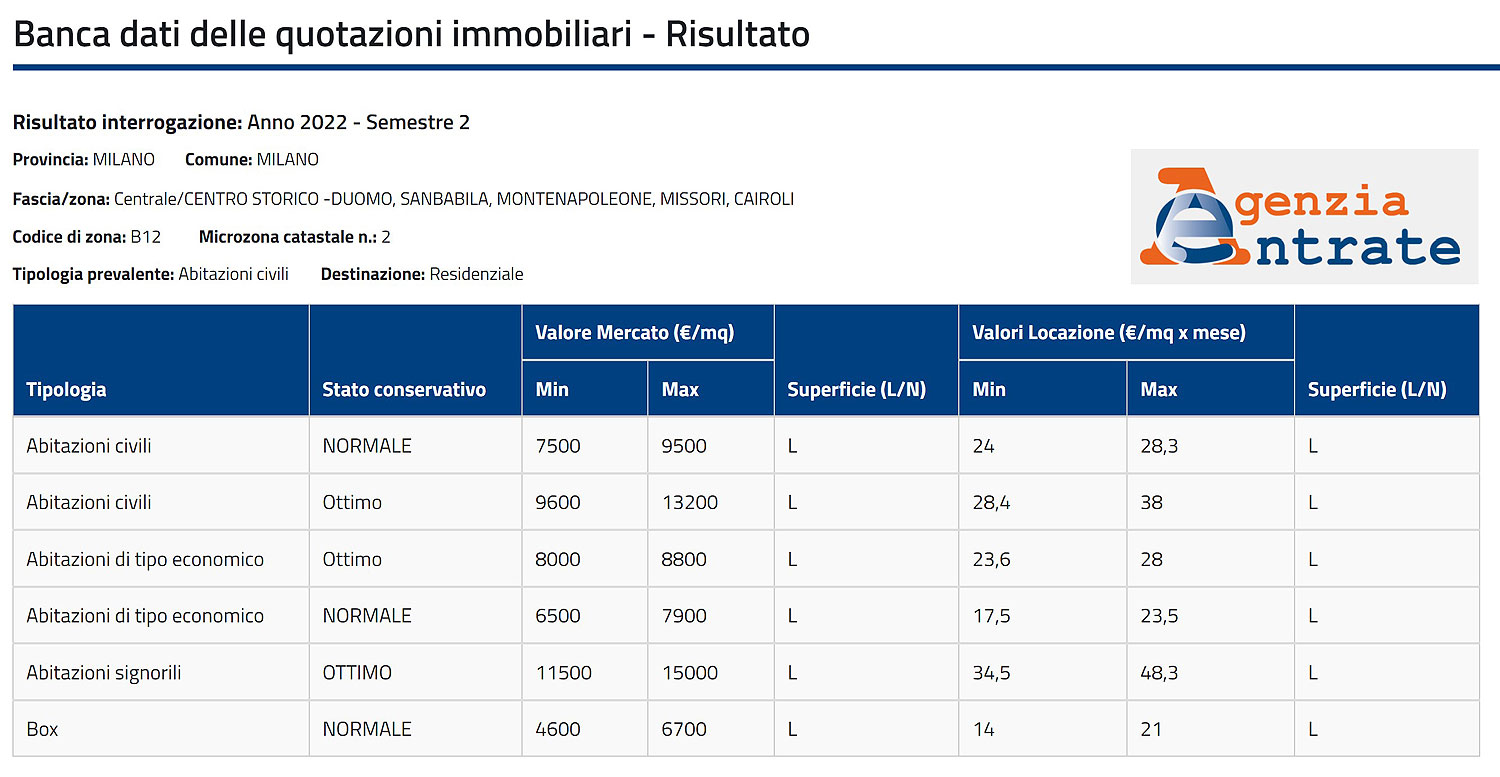

1] OMI Method

The Revenue Tax Office (Agenzia delle Entrate) collects nationwide sales data, sorted into a mega-database by geographic area and property type, giving prices per square meter.

This database, known as OMI (Osservatorio Mercato Immobiliare), is available for free [3].

For example, in the historic center of Milan, areas like Duomo, San Babila, Missori, Cairoli and Montenapoleone show market values ranging from €7,500/m² for a standard-condition home to €13,200/m² for one in excellent condition.

“OMI value per square meter” x “Commercial surface area” = “Basic, generic property value”.

Critique: The OMI method's level of aggregation is excessive. Take Milan, for example—a city of 2 million people divided into just 41 homogeneous zones. The data is accurate and updated every six months, but it’s far too generic. It doesn’t consider specific details like renovations or unique features of individual properties. This method is great for a rough idea, but don’t expect much precision.

2] Comparative Method

This method compares online real estate listings of properties similar to yours in size, location, and features.

But here's the kicker—these listings are often a wild approximation, mainly reflecting sellers' asking prices, not the final sale price.

For instance, I recently sold a penthouse in Milan for the exact listed price (no discount), while a villa in Tuscany went for 38% less than the asking price!

Still, the comparative method offers a free second opinion alongside the OMI estimate.

3] Rogiti in chiaro

Simple and precise.

This paid service from our agency provides an extremely accurate valuation based on actual, verified sales data from notarial deeds. We pull data on properties sold in the same building (for apartments) or nearby (for independent villas), then apply over 40 correction factors to determine the exact value per square meter.

With "Rogiti in chiaro," we provide clarity and confidence in your property's market value. Say goodbye to uncertainty in pricing.

Get Your Valuation Now!

4] Depreciated Reconstruction Cost

This method estimates the cost of rebuilding a property from scratch, minus depreciation. It’s useful for evaluating new commercial properties.

But, honestly, in my 15-year career, I’ve never seen it applied to the residential market, which mainly consists of older homes where depreciation is tricky to calculate.

5] Income Capitalization

This method works for any income-generating property, whether commercial or residential.

You calculate the net operating income (NOI) by subtracting costs from rental income and then dividing by the capitalization rate (Cap Rate) to get the property’s value. This method is rarely used in Italy—I’ve only seen it applied to rental properties in Milan.

Q&A for real estate appraisal in Italy

What is the difference between cadastral value and market value in Italy?

The cadastral value of a property is used exclusively for tax purposes, such as calculating purchase taxes, IMU (property tax), inheritance, and gift taxes. It has no bearing on the actual market value.

The market value, on the other hand, is the price at which you can realistically sell or buy a property. In other words, one is for the tax office, the other is for your wallet!

How to use appraisal results for negotiation

An appraisal is the key difference between an amateur taking wild guesses and a professional playing it smart. An objective evaluation of a property's economic, urban, and legal aspects strengthens your negotiating position, giving you the facts you need to negotiate confidently.

Judicial auctions and foreclosed properties

Real estate auctions offer a great opportunity to buy at lower prices. I know this firsthand, as my family recently invested in a penthouse in Milan by purchasing it at a court auction.

In these cases, every auction is accompanied by an official property appraisal, which should be your first point of reference—yes, even before the price!

If you want more information, feel free to contact me!

Elena Manzhos: Mother of two beautiful children, wife, and real estate agent for over 15 years. More than 20 years ago, I moved to Italy from Eastern Europe. I have always had a deep-seated passion for houses; as a child for the Barbie house, and now as a real estate professional, my love for luxurious properties is unwavering.

Fiaip,

Linkedin,

Instagram,

Facebook.