So, you've found your dream villa in Italy, and you're ready to dive headfirst into la dolce vita.

But wait… there’s still a little detail you need to figure out: the cadastral value of your property.

"Valore catastale? What's that?"

Well, it’s the magical number the Italian tax authorities use to decide how much you’ll pay when buying, inheriting property, and other delightful surprises. Spoiler alert: it has nothing to do with what your property is actually worth on the market.

Trust me, this number is often shockingly low compared to the actual market value.

Yes, you heard that right.

The Italian government has generously created a system in which your tax bill is calculated based on a figure that’s usually much less than your villa's true worth.

In this guide, you will find out the cadastral value of your property, what it means for your taxes, and how it’s calculated.

What is the cadastral value of a property in Italy

The cadastral value (valore catastale) of a property in Italy is a value, expressed in euro, based on which certain taxes due in the event of purchase, donation, inheritance, annual taxes such as IMU (Imposta Municipale Unica) and TARI (Tassa sui Rifiuti) are calculated.

In no way does the cadastral value represent the market value. They are two very different concepts.

In fact, the biggest misunderstanding of all that some people fall into is to confuse the cadastral value of a property with its market value. If that lovely villa cost you as much as EUR 2 million, it does not mean that its cadastral value is equivalent, because real estate transactions are affected by the laws of supply and demand as in all economic systems. Whereas cadastral value is a predefined value established by the Land Registry (Catasto).

Curious about the cadastral value of a property?

Just reach out! I can calculate it anywhere in Italy!

However.

The cadastral value is decisive in establishing the minimum sale price and rent of a property to avoid a tax assessment.

Let me explain.

If you sell or buy a property in Italy at a price higher than the cadastral value, the Italian tax authorities cannot, by law, make any tax assessment.

As a licensed real estate agent, I have never sold a property at a price lower than its cadastral value.

Luckily!

Another misunderstanding that many people need clarification on is the cadastral value with the cadastral income (rendita catastale), but for the latter, since the two values are somewhat related, I will give you a practical example later.

How to calculate cadastral value of property in Italy

Now, I'll astound you.

Calculating the cadastral value is surprisingly straightforward!

The cadastral value is calculated by multiplying the “rendita catastale” (or the dominical income “reddito dominicale” in the case of agricultural land) by specific coefficients, which vary according to the cadastral category of the property and its use (primary house, second house, commercial property, etc.).

Note: the “rendita catastale” has nothing to do with its definition. Don’t get confused. It is just a theoretical cadastral income.

The coefficients allow the cadastral value to be adapted to the property's specific function, taking into account its type and use.

| Cadastral category |

Coefficients to calculate cadastral value for sale, donation, inheritance |

| Prima casa "Primary home" |

115,5 |

| A, C (excluding A/10, C/1) |

126 |

| B |

147 |

I can already imagine the question... “how to find the cadastral income (rendita catastale)?”

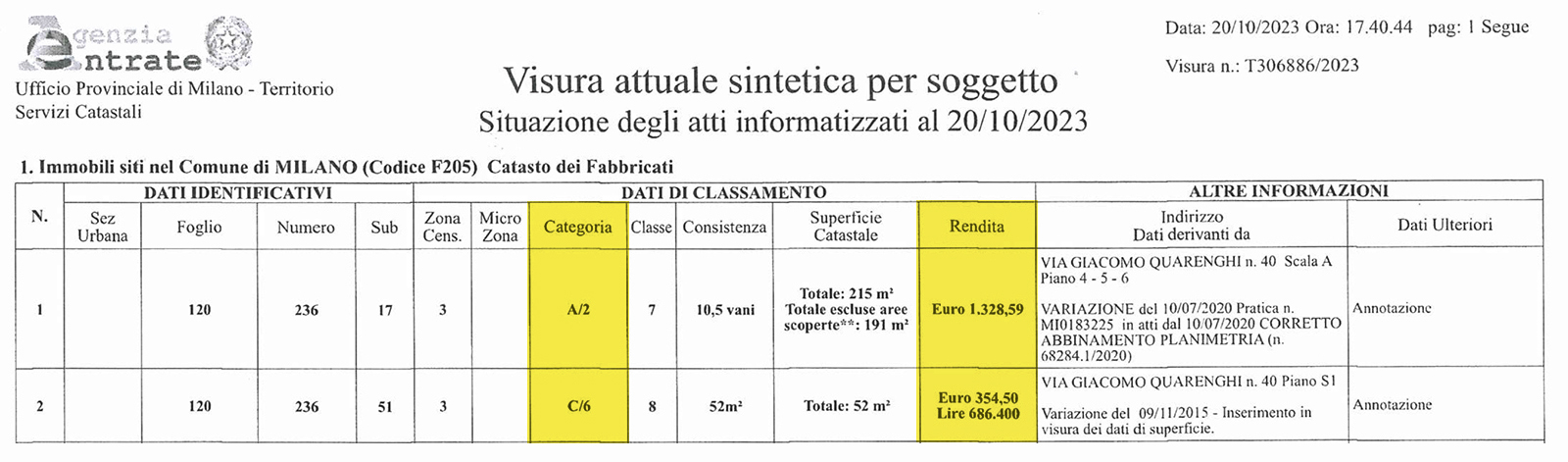

You can find the “rendita catastale” in the “visura catastale” (see the example in the next paragraph), in the income tax declaration (dichiarazione dei redditi) that your Italian accountant prepares every year, or in the Sister portal of the Agenzia delle Entrate [1].

Alternatively, you can ask me (Contact me for any help you may need)!

Example calculation for residential property

In the “Visura catastale” (cadastral survey) below, the flat belongs to category A/2 and “rendita catastale” (cadastral income) is 1,328.59 euros.

The cadastral value of the flat is equal to:

- Cadastral value “primary home” = 1,328.59 x 115.5 = 153,452.15 euros.

- Cadastral value “second home” = 1,328.59 x 126 = 167,402.34 euros.

You already know this... but here is the difference between primary and second home.

The primary house (prima casa) is the main home, located in the municipality of residence or to which you plan to move within 18 months of purchase, while the second house is any property that does not serve as your primary residence, but is used for holidays, investments, or rentals.

Common mistakes to avoid

1] Incorrect Rendita Catastale

I previously told you that the rendita catastale is a fixed value. This is a partial truth.

The rendita catastale can change when the property is changed, renovated, extended, or when the Agenzia delle Entrate (Tax Agency) does not accept the value proposed by your surveyor (the Tax Agency has 12 months to revise the value).

If you either overlook updating your rendita catastale or fail to verify its accuracy, you could be underpaying or overpaying on your taxes. Over time, this could lead to penalties, fines, or, worst case, a dispute with the tax authorities.

To avoid this mistake, it's crucial to always ensure that the cadastral documentation is up to date, especially after significant changes to your property. This proactive approach can save you from potential tax issues in the future.

2] Using Market Value Instead of Cadastral Value

Another common mistake occurs when property buyers and sellers confuse market value with cadastral value. Some people, especially foreign buyers, assume that the taxes will be calculated based on the market value, which can be significantly higher.

This misunderstanding can lead to errors when budgeting for a purchase or sale, potentially resulting in unnecessary financial stress. If in doubt, it's always best to consult with a real estate professional or a notary to ensure you're on the right track.

3] Cadastral value for IMU calculation

The cadastral value used to calculate the IMU tax amount differs from that used for sales, donations, inheritance, and minimum rent taxes.

It is still a simple multiplication of the "Rendita catastale" (cadastral rent), but the coefficient to be used is different.

For simplicity's sake, I propose this table.

| CADASTRAL CATEGORY |

CADASTRAL VALUE FOR IMU |

| A (escl. A/10) |

"rendita catastale" x 168 |

| A/10 |

"rendita catastale" x 84 |

| B |

"rendita catastale" x 147 |

| C/1 |

"rendita catastale" x 57,75 |

| C/2, C/6, C/7 |

"rendita catastale" x 168 |

| C/3, C/4, C/5 |

"rendita catastale" x 147 |

| D (escl. D/5) |

"rendita catastale" x 68,25 |

| D/5 |

"rendita catastale" x 84 |

To calculate the amount of IMU tax (Imposta Municipale Unica), you need to know the property's share of ownership and the rate applied by the municipality where the property is located.

You can subtract any concessions from the value obtained, such as those for primary-home properties or flats given on gratuitous loan to first-degree relatives (in the latter case the reduction is 25% of the established rent).

Are you about to buy a house and want to know its real value?

Contact me right now... with the ‘Rogiti in chiaro’ service you will receive notarial deeds of properties sold in the same building!

FAQ

How Is Cadastral Value updated?

The cadastral value in Italy is updated by the Catasto / Agenzia delle Entrate in two main ways:

- At the owner's request when there are significant changes such as renovations, extensions or changes of use (from hotel to villa, or from flat to office). In this case, the owner appoints a qualified technician (surveyor, architect or engineer) to send the variation declaration;

- At Catasto’s request, if the property is wrongly classified or following national or local cadastral revisions.

Does Cadastral Value impact mortgage taxes?

The cadastral value does not affect the mortgage taxes, which range from 50 to 200 euros in the case of a purchase and sale contract.

How do you value a property in Italy?

To value property in Italy, you typically look at recent sales of similar properties in the area (we, licensed realtors, may download notarial deeds of properties sold nearby) to estimate its market value, considering factors like size, location, and condition.

The potential rental income and the return on investment play a very important role for rental properties.

You can also rarely use the cost-based approach.

The cadastral value is not an option for a precise assessment.

How do I find property records in Italy?

Only licensed professionals, such as real estate agents, notaries, surveyors, or lawyers, are allowed to access real estate property registers. Registers contain information on properties, owners, mortgages, liens, encumbrances, and transaction history.

How to find a property owner

To find out who owns a property in Italy, you can access either the Catasto or the Conservatoria dei Registri Immobiliari. The Catasto provides non-binding information like floorplans and fiscal data but may need to be updated. The Conservatoria is essential for legally binding ownership details, as it records all transactions and claims on properties.

How to transfer property ownership

A deed signed by an Italian notary must be executed to transfer property ownership in Italy. This can be done through a sale or a gift (please pay attention to taxes and legal implications!). The deed is then transcribed in the Real Estate Register and registered with the Fiscal Office to formalize the transaction and pay the related taxes.

Elena Manzhos: Mother of two beautiful children, wife, and real estate agent for over 15 years. More than 20 years ago, I moved to Italy from Eastern Europe. I have always had a deep-seated passion for houses; as a child for the Barbie house, and now as a real estate professional, my love for luxurious properties is unwavering.

Fiaip,

Linkedin,

Instagram,

Facebook.