Ah, Italy! The land of saints, poets, sailors, and… “self-proclaimed property appraisers.”

I know, I know—you're thinking the saying goes differently. But trust me, after 15 years in the real estate business, I've earned the right to update it. I’ve seen it all: surveyors, property owners, and even doormen pulling property valuations out of thin air like seasoned magicians.

So, let’s get serious (but not too serious).

In this piece, I’ll take you through the most reliable valuation methods and the key factors that truly determine a property’s worth in Milan. Because if we’re going to make numbers up, at least let’s make them up scientifically!

Property Valuation in Milan: The Best Methods Compared

✅ The Best Method for Property Valuation in Milan: Rogiti in Chiaro (Clear Deeds Method)

The only truly reliable way to determine a property’s value is the Rogiti in Chiaro method, because it relies on actual notarial sales records, not speculation or wishful thinking.

Unlike other approaches, which are often based on assumptions or inflated listing prices, this method digs into real transactions. It starts by identifying properties that have recently sold in the same building, ensuring a direct and precise comparison. Instead of vague estimates, it retrieves official deed records that specify the exact selling price, square footage, floor level, and transaction date.

From there, the method determines the real price per square meter and fine-tunes it with adjustments for renovation status, position within the building, and market fluctuations like inflation or shifting demand.

This ensures that the valuation isn’t just a theoretical exercise, but a reflection of what buyers are actually willing to pay in that specific location and time period.

What makes Rogiti in Chiaro superior is its grounding in facts, not fiction. It eliminates the distortions of speculative listing prices, outdated sales data, or fluctuating rental yields.

If you want to know the real market value of a property in Milan, forget industry myths and unreliable formulas—this is the only method that delivers an accurate, data-driven price.

Selling or buying in Milan? Don’t rely on outdated methods—get a real, data-driven property valuation.

Contact us now!

How to calculate property value in Milan? Rogiti in Chiaro: step by step

To calculate property value in Milan accurately, you need to analyze recent sales data from notarial deeds—known as “Rogiti in Chiaro.”

So, you want to know the real value of a specific property? Not a ballpark figure, not a "my neighbour says" estimate, but an actual, data-backed valuation? Well, it all starts with one crucial detail: the exact address, down to the street number.

Here’s how Rogiti in Chiaro works its magic:

- Step 1: Identifying the Real Comparables

The system pinpoints all the properties in the same building that have been sold in recent years. No random market comparisons—just real transactions that happened right there.

- Step 2: Gathering the Hard Facts

For each sale, we retrieve a copy of the notarial deed (rogito). This isn’t just a vague estimate—it’s the ultimate real estate truth serum. The deed contains the actual sale price, square footage, floor level, transaction date, and much more. No guessing, no inflated listing prices, just pure, notarized data.

- Step 3: Adjusting for Reality

Not all apartments in the same building are created equal. A 200 sqm penthouse, fully renovated, doesn’t hold the same value as a 60 sqm fixer-upper on the second floor. Using a precise adjustment process, we factor in these differences so that comparisons actually make sense.

- Step 4: Calculating the Price per Square Meter

Once the adjustments are applied, we determine the first rough valuation per square meter. But hold on—we’re not stopping here.

- Step 5: Factoring in the Market & Inflation

A property’s value isn’t frozen in time. We refine the €/sqm figure by accounting for inflation trends and real estate market shifts. Only after this final layer of analysis do we arrive at the true market value—the price at which the property would actually sell today.

Why is Rogiti in Chiaro the Best Valuation Method?

Because it leaves no room for fantasy. It’s a method that considers every possible variable, using scientific analysis, statistics, and real market trends. It may not be a crystal ball, but when it comes to predicting property values, it gets pretty damn close.

When it comes to property valuation, many real estate agents still cling to so-called “traditional” methods straight out of industry manuals. But do they actually work? Let's break them down one by one and expose their flaws.

❌ Cost Approach: The Construction Cost Method

This method calculates a property's value based on construction costs, adding the value of the land and building materials while subtracting depreciation. Sounds logical, right? Wrong.

This method ignores the real estate market's actual trends and buyer demand. It doesn’t take into account perceived value, which is influenced by location, architectural style, and urban context. A historic apartment in Milan isn’t just worth the sum of its bricks and mortar—it’s the uniqueness, the prestige, and the history that define its value.

Who uses this method? Insurance companies. Who shouldn’t use it? Anyone trying to buy or sell a home at the right price.

❌ Income Approach: The Rental Yield Method

This method estimates a property's value based on potential rental income. Sounds like a solid plan—until reality hits. Why? Because: rental prices fluctuate, tax regulations change and expected returns are subject to unpredictable factors.

Real estate investors in Milan may find this method appealing, but it’s not a reliable way to determine the final sale price of a property.

❌ Comparative Market Analysis: Looking at Nearby Listings

One of the most common methods used by real estate agents involves comparing asking prices of similar properties within a 150-300 meter radius. Popular real estate portals like Immobiliare.it[1] rely on this approach.

Seems reasonable, right? Here’s the catch: listings don’t reflect actual selling prices. Two seemingly identical apartments, located just meters apart, can sell at vastly different prices based on: floor level, renovation status, exposure & natural light, and seller’s urgency.

Conclusion? This method is widely used but highly unreliable. It’s based on fictional prices and ignores crucial details that set one property apart from another.

❌ Historical Analysis: Using Past Sales Data

This approach relies on past transaction prices and data from official databases, such as those provided by the Italian Revenue Agency[2]. At first glance, it appears more scientific—after all, it’s based on real sales. But there’s a problem: the real estate market never stands still.

Past property prices in Milan (from two or three years ago) may not accurately reflect today’s market conditions. Economic trends, interest rates, and urban development projects can all shift property values significantly.

If this method worked flawlessly, we’d all be able to predict property values with certainty. Spoiler: We can’t.

Key Factors That Determine Property Value in Milan

The value of a home in Milan isn’t random—it’s shaped by several key factors, from location and square footage to property condition and market demand. If you’re trying to understand why one apartment sells for a fortune while another struggles to attract buyers, here’s what truly matters:

- Location, Location, Location - No surprise here—the neighborhood is the single most decisive factor in determining a home’s value. Milan’s most exclusive areas, such as Centro Storico, Brera, and Porta Nuova, command sky-high prices (often exceeding €10,000 per square meter) thanks to their proximity to cultural landmarks, top-tier services, and exceptional transport links. Properties near Cadorna, Centrale, and Garibaldi, which are well-connected via metro, tram, and bus networks, are also in high demand. Buyers—especially professionals—prioritize convenience, and a home with easy access to Milan’s transportation system instantly gains value.

- Size & Square Footage - Let’s be real: in Milanese dialect, the saying goes “più sé gross, più sé mei”—the bigger, the better. Square footage directly impacts price, and additional spaces like balconies, terraces, and gardens have become hot commodities, especially after the Covid era reshaped buyers’ preferences.

- Property Condition & Special Features - A home’s state of maintenance—and its building’s overall condition—plays a crucial role in valuation. Features such as elevators, private parking, 24/7 security, panoramic views, and proximity to public transport, schools, and shops all add significant value. Buyers, especially international investors, prefer move-in-ready properties that require little to no renovation. In Milan’s competitive market, newly renovated homes always fetch a higher price than fixer-uppers.

In short, Milan’s real estate prices aren’t just about bricks and mortar—they’re about prestige, practicality, and prime location. If you’re buying or selling, understanding these factors makes all the difference between a great deal and a costly mistake.

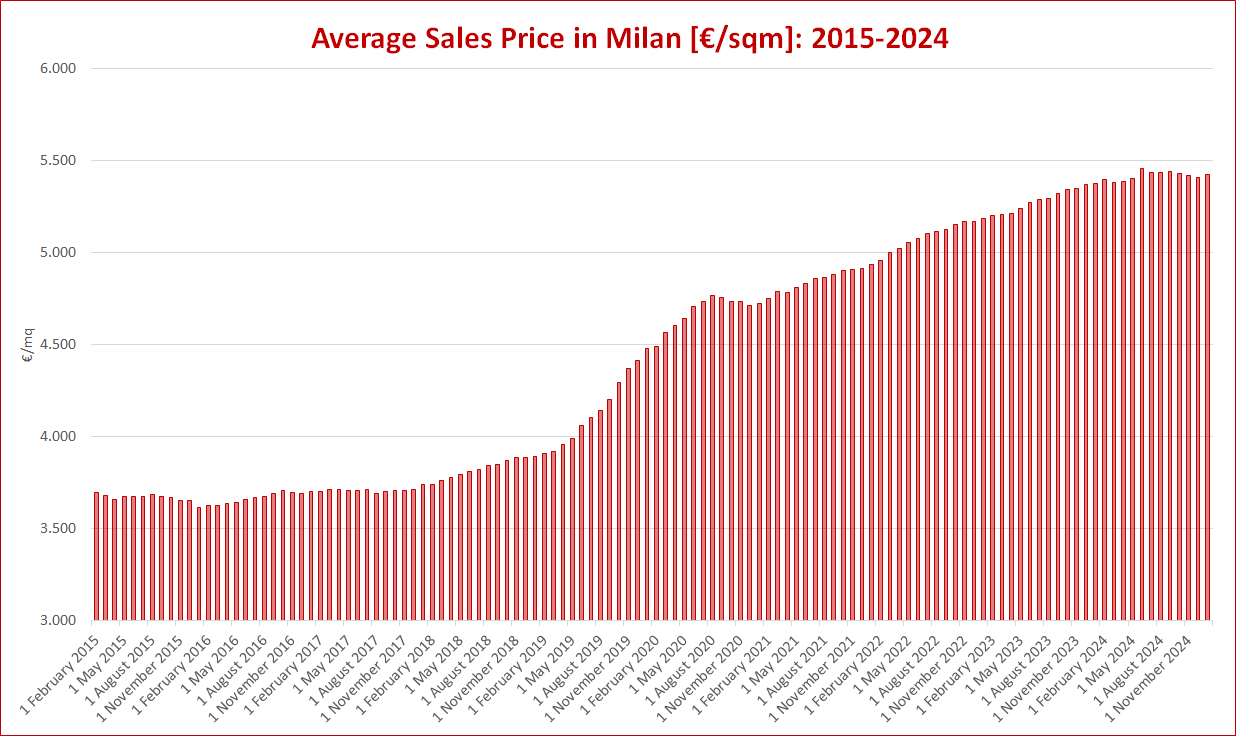

Milan Real Estate by the Numbers

Milan isn’t just a city—it’s a powerhouse. A financial, cultural, and real estate hub that continues to evolve, grow, and attract new residents. If you want to understand why its property market remains one of the hottest in Italy, let’s break it down in numbers.

- 1,366,240 current residents (expected to hit 1.5 million by 2040—yes, the city is getting even more crowded)

- 720,333 households, with a whopping 71% homeownership rate (clearly, owning a home in Milan is still a dream for many)

- 193,660 non-resident students, drawn by Milan’s top-tier universities

- 182 km² total area—meaning every square meter counts in this dense, high-demand market

- 35,280 €/year average per capita income (+62% compared to the national average)

- 5.4% unemployment rate, significantly lower than Italy’s 8.3% national average

- +15% Milan's GDP growth in 2023, showing an economy that’s far from slowing down

- 560,000 daily commuters, keeping the city’s pulse beating

Milan Real Estate Market: Key Insights

The Milan real estate market in 2024 has shown resilience and selectivity. While the number of transactions slightly declined, demand for premium and new-build properties remains strong, driven by local professionals and international buyers. Below are some key market insights for 2024:

- 24,832 property transactions in 2023, down 13% from 2022—a slight contraction, but nothing alarming

- 5,378 €/sqm average sale price in Milan

- 8,858 €/sqm for new-build properties, confirming the growing preference for modern, move-in-ready homes

- 3,480 €/sqm price gap between new and used properties (a 40% premium for brand-new homes)

What Does This Mean for Milan’s Real Estate Future?

Milan’s population is growing, its economy is thriving, and its real estate remains one of the most attractive investments in Italy. While the number of transactions has slowed slightly, demand for high-quality properties remains strong, especially for new-builds.

With a booming economy, world-class universities, and a job market that outperforms the rest of the country, Milan continues to be a magnet for professionals, investors, and students alike. The numbers don’t lie—this is a city that never stops evolving. If you're thinking of buying or selling, Milan is still the place to be.

FAQ

Who Can Appraise a Property?

Property valuations can be carried out by real estate agents, surveyors, engineers, architects, and other professionals registered in official valuation boards. In short, anyone with expertise and credentials—not just your neighbor who “knows a guy.”

What’s the Current Real Estate Trend in Milan?

Milan’s housing market has undergone a major shift. In 2019, 26% of property searches were for two-bedroom apartments for sale. Fast forward to 2024, and 32% of searches are for rental properties instead. This signals a growing preference for flexibility over long-term ownership commitments.

What’s the Future of Milan’s Real Estate Market?

Milan is a city in motion, shaped by job mobility, economic shifts, and evolving housing needs. The demand for rentals is likely to remain strong, but the market will adapt dynamically to future trends. Expect more hybrid living solutions and new developments catering to both buyers and renters.

Milan’s property market is changing fast! Stay ahead with accurate insights and expert guidance.

Contact us today!

Is It Still Worth Buying Property in Milan in 2024?

That depends on your financial goals. If you’re looking for stability and a long-term investment, buying still makes sense. Here’s a full guide for foreigners buying property in Italy. However, if you value flexibility and lower financial commitments, renting could be the smarter choice.

Where Should You Buy for Luxury & Prestige?

If you want high-end real estate, the top areas are:

- ✔ Centro Storico – Historic charm, top-tier cultural landmarks

- ✔ Brera – Artistic vibes, elegant townhouses, boutique lifestyle

- ✔ CityLife-Garibaldi-Porta Nuova – Modern skyscrapers, luxury condos, and high-end shopping

Be prepared: prices in these areas easily exceed €10,000/sqm.

How to Choose the Best Neighborhood in Milan?

The best area to live in Milan depends entirely on your lifestyle. If you’re a nature lover, the 3-30-300 Rule is a great guideline: choose a neighborhood where you can see at least three trees from your home, where 30% of the area is dedicated to green spaces, and where there’s a park within 300 meters.

If nightlife and culture are what you’re after, Navigli and Brera offer the best mix of lively bars, art galleries, and historic charm. On the other hand, if you work in business and innovation and prefer a sleek, modern environment, CityLife is the ultimate destination, with its futuristic skyline and high-end residential developments.

Is Milan at Risk of a Real Estate Bubble?

For now, Milan is safe from a housing bubble. According to the UBS Global Real Estate Bubble Index[3], Italy’s real estate market hasn’t been over-inflated by expansionary monetary policies like other European cities. Yes, prices have risen, but not at a dangerous pace.

For now, Milan remains a strong and stable market. But what do you think? Drop your comments and let’s discuss!

Elena Manzhos: Mother of two beautiful children, wife, and real estate agent for over 15 years. More than 20 years ago, I moved to Italy from Eastern Europe. I have always had a deep-seated passion for houses; my love for luxurious properties is unwavering.

Fiaip,

Linkedin,

Instagram,

Facebook.